What Is The Import Export Code (IEC)?

- The Need for an Import Export Code

- Who Can Apply for Import Export Code?

- Who is Exempted from IEC?

- Common Mistakes to Avoid During IEC Application

- How to Modify or Update IEC Information?

- Documents Required for Import Export Code

- How to Apply for the IEC Code Online in India?

- What is Import Export Code Validity?

- Import Export Code for eCommerce Sellers

- How to Check the Status or Verify an IEC?

- Conclusion

- IEC is a 10-digit code issued by DGFT, mandatory for importing/exporting in India.

- Required for customs clearance, international payments, and availing government export benefits.

- Eligible: Individuals, proprietorships, partnerships, companies, LLPs, and trusts involved in trade.

- Exemptions: Personal use, government departments, NGOs, certain treaty-based imports/exports, and RBI transactions.

- Documents: PAN, address proof, passport-sized photo, and cancelled cheque.

- Apply online via DGFT portal; fee ₹500; certificate issued electronically.

- Valid for lifetime; annual confirmation and updates required.

- One IEC suffices for all branches; essential for eCommerce exporters.

If you run a small business and want to take your products beyond your local market, understanding export rules can feel confusing. To legally sell goods internationally and receive payments in foreign currency, you need an Import Export Code (IEC). This 10-digit code, issued by the DGFT (Director General of Foreign Trade), ensures your business is recognised for import and export activities and allows you to access government benefits for exporters.

In this guide, we will explain what IE code is, why it matters for your business growth, and how you can get it step by step.

The Need for an Import Export Code

As mentioned above, importer exporter code is a mandatory requirement for those involved in international trade in India. Here is a closer look at the need for this code:

- IEC is mandatory under the Foreign Trade Act, 1992. It ensures that those engaged in international trade adhere to the standard trade regulations. This helps prevent illegal trade practices.

- IEC is essential for customs clearance. Customs authorities require this code to clear the shipments. It ensures that goods comply with legal norms.

- Banks demand IEC for processing international trade transactions. The IEC helps banks verify the legitimacy of the transactions and ensures they are in compliance with trade laws.

- The Indian government offers various benefits to exporters. This includes duty drawbacks, export promotion schemes, and subsidies among others. An IEC is necessary to avail these benefits.

- Having an IEC enhances the credibility of a business in the international market. It serves as proof that the business is registered and recognised by the Indian government for conducting import-export activities.

- It helps the government collect and analyse trade data. Accurate data on imports and exports helps the government in making effective trade policies. This improves the country’s trade performance.

Who Can Apply for Import Export Code?

Now that you know what is import export code and why it is needed, let us take a quick look at who can apply for it:

- Any individual who wants to import or export goods for commercial purposes can apply for this code.

- Proprietorship firms, partnerships, limited companies, and trusts dealing in international trade can also apply for IEC.

Who is Exempted from IEC?

Although most international traders need an IEC, certain groups are exempt under the Foreign Trade (Regulation) Rules, 1993. These exemptions make it easier for governments, individuals, and non-commercial organisations to carry out imports and exports.

- Individuals Importing or Exporting for Personal Use

People importing or exporting goods solely for personal use, not for business or trade, are not required to have an IEC.

Example: Bringing home furniture from another country for personal use or sending gifts abroad.

- Government Departments and Ministries

Central Government, State Government, or their departments do not need an IEC for their imports or exports.

Example: Importing scientific equipment for research or defense purposes.

- Notified Charitable Institutions and Registered Non-Commercial Bodies

Charitable trusts, schools, hospitals, and other government-recognised organisations registered under laws like the Societies Registration Act or Trusts Act may be exempt.

Example: A government-approved NGO importing medical supplies for free distribution.

- Importers and Exporters Registered under Other Specific Codes

Certain groups registered with other regulatory bodies can use those credentials instead of an IEC for specific import/export activities.

Example: Importers registered under GST using their PAN-based business identification for certain import/export purposes.

- Imports and Exports Covered under International Agreements or Notifications

Goods imported or exported under special trade agreements, diplomatic privileges, or bilateral treaties are exempt.

Example: Embassies bringing in goods for official use.

- Imports and Exports by the Reserve Bank of India (RBI)

Transactions conducted by the RBI or on behalf of the Government of India do not require an IEC.

- Other Exemptions Notified by DGFT

DGFT may grant exemptions in special cases, such as disaster relief shipments or humanitarian aid.

India requires an IE code for all commercial import and export activities except for individuals, government bodies, or authorised institutions. Businesses should verify their eligibility before applying to avoid compliance issues later.

Common Mistakes to Avoid During IEC Application

Even though applying for an Import Export Code is straightforward, small mistakes can slow down the process or lead to rejection. Here are common errors to watch out for when submitting your IEC application online:

- Mismatch Between Business Name and PAN Details

The name and address on your PAN card must exactly match the details in your application. Even a minor spelling error can cause verification to fail.

- Incorrect or Outdated Contact Information

Ensure your mobile number and email address are correct and active. DGFT will send OTPs, updates, and your IEC certificate to the email address provided.

- Uploading Blurred or Unreadable Documents

Always scan and upload clear copies of PAN, address proof, cancelled cheque, and other required documents. Poor-quality uploads may lead to rejection.

- Using Personal Bank Accounts for Business Transactions

The bank account submitted must belong to the business applying for IEC. Personal savings accounts should not be used for import/export activities.

- Incorrect Fee Payment or Incomplete Application Submission

The application fee is ₹500, payable through the DGFT portal. Ensure the payment is successful and retain the receipt as proof.

- Not Updating Changes After Approval

If your address, ownership, or bank information changes after obtaining IEC, update it immediately. Failure to do so may create compliance issues in the future.

Before submitting your application, double-check all details and ensure your documents are valid and up to date. Accurate information ensures a smooth IEC approval process.

How to Modify or Update IEC Information?

Keeping your IEC up to date is important. Any changes to your business, such as address, partners, directors, or bank accounts, must be reflected in the IEC records.

Steps to Update IEC Online:

- Go to the DGFT website.

- Log in using the username and password created during registration.

- Navigate to IEC Profile Management.

- Click Start New Application and select Amend IEC.

- Update the necessary information, such as a new bank account or address.

- Upload supporting documents, like a bank statement or address proof.

- Pay any applicable fees for the amendment.

- Submit the application for approval.

After verification, DGFT will email the updated IEC certificate.

Annual Confirmation:

IEC information must be confirmed online once every financial year, even if no changes are made. Failure to confirm may result in temporary deactivation until revalidation.

Documents Required for Import Export Code

Here is the list of documents needed for import export code:

- PAN Card

- Passport size photograph

- Copy of Aadhar Card, Voter ID, Passport or Driving License

- Address proof

- Cancelled cheque

How to Apply for the IEC Code Online in India?

In order to apply and get the IE code in India, there are certain processes to follow. Every applicant must follow these steps.

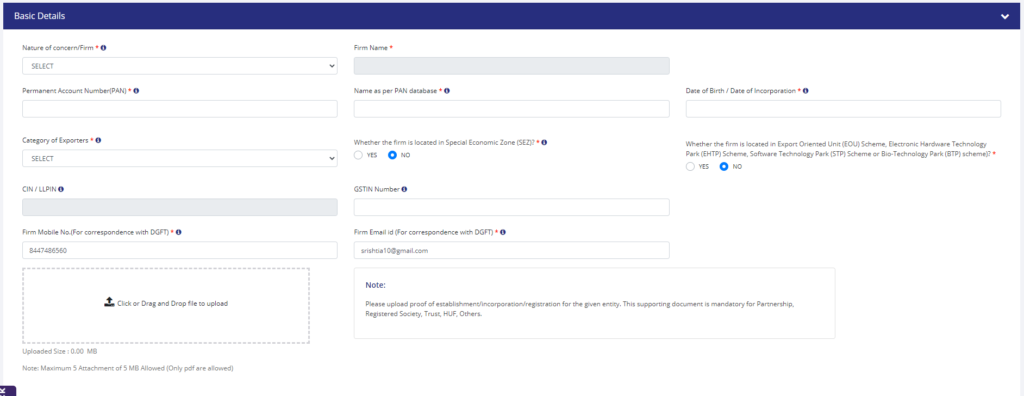

- You need to fill out the application form for IEC online on the DGFT website.

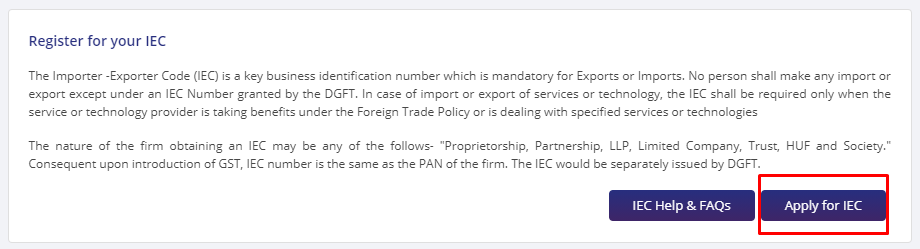

- Go to www.dgft.gov.in and click on ‘Apply for IEC‘.

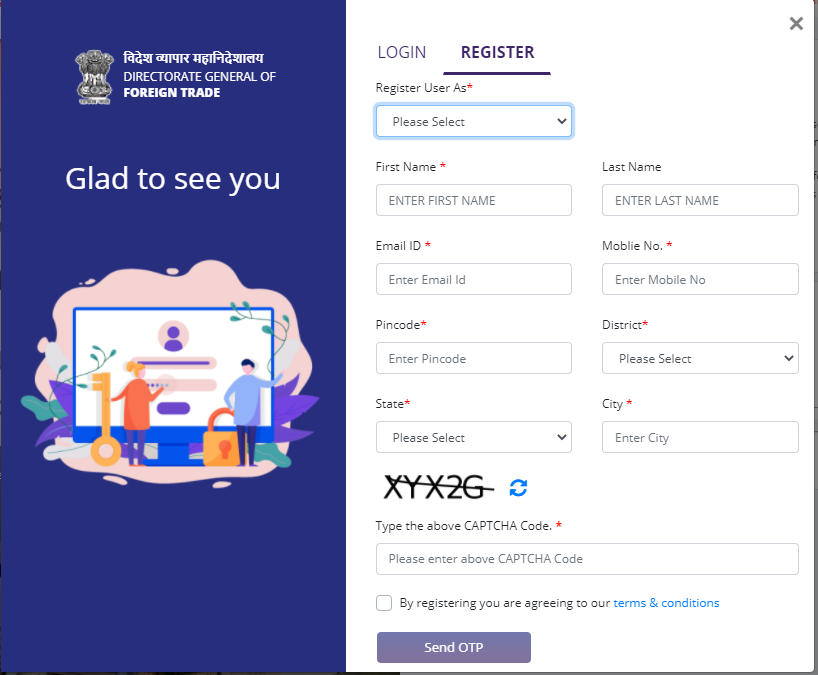

- Fill in all details to register as a new user.

You will receive an OTP on your mobile number and email id for verification.

After verifying your mobile and email, a username and password will be sent to your registered email id. Log in with these credentials.

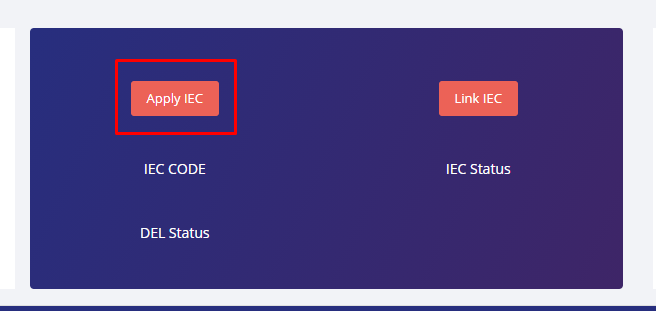

- After you log in to your account, select ‘Apply IEC (Import Export Code)’

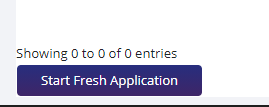

- Next, click on ‘Start Fresh Application‘

- Fill in all details asked and upload the required documents

- After submitting the application, pay the application fee of INR 500.

Post payment approval, you will receive the IEC certificate in your registered email.

After you get the IEC (Import Export Code) code, you can engage in exporting and importing businesses.

What is Import Export Code Validity?

The IEC is valid for lifetime. It does not have to be renewed. However, it is important to keep it updated. Any changes in the bank details, address, or other information mentioned on it must be updated to ensure compliance. You can make the amendments by filling the amendment application on the DGFT website.

In case, you do not want to continue the import-export activities, then you can surrender the IEC. It will be deactivated by the DGFT.

Import Export Code for eCommerce Sellers

With the rise of global online marketplaces, many small sellers now ship goods internationally. To legally send goods out of India, an IEC is required, whether you sell on Amazon Global, Etsy, eBay, Shopify, or Meesho Export.

- Mandatory for Exporting Goods Abroad: Online sellers shipping items to other countries or accepting payments in foreign currencies must register an IEC under their own name or their business name.

- Applicable Even to Small or Individual Sellers: You can apply for an IEC using just your personal PAN and proof of address. Freelancers, artists, or home-based business owners do not need a registered company to obtain IEC.

- Required for Payment Reconciliation: As per RBI rules and the Foreign Exchange Management Act, banks and eCommerce platforms require your IEC to process international money transfers.

- Simplified DGFT Process: eCommerce exporters can apply for IEC online, upload minimal documents, and receive the code within a few days, making it accessible even for small sellers.

Example: A jewelry designer from Jaipur selling handmade items on Etsy to the US needs an IEC to legally export products and receive international payments.

How to Check the Status or Verify an IEC?

Whether you have just applied for an IEC or want to confirm that your existing code is still valid, the DGFT portal allows easy verification.

Steps to Verify IEC:

- Go to the DGFT IEC Verification page.

- Enter your PAN number and IEC number.

- Fill in the captcha and click Search.

- The system will display:

- IEC holder’s name and business type

- Date of issue and current status (Active/Inactive/Suspended)

- DGFT regional office details

This verification tool can also be used by importers, exporters, and banks to ensure that a business is legitimate before engaging in trade.

Conclusion

The Import Export Code (IEC) is more than just a regulatory requirement; it is your key to growing your business beyond local markets and tapping into global opportunities. With an IEC, you can legally export goods, receive international payments, and access government benefits that can boost your profits. The process is simple, fully online, and quick, even for small or home-based sellers.

By obtaining and maintaining an IEC, you not only stay compliant with the law but also build credibility with customers, banks, and marketplaces, opening doors to sustainable growth in international trade.

Yes, IEC is required to legally receive payments in foreign currency for services like IT, consulting, or freelancing, ensuring compliance with RBI and FEMA regulations.

Yes, a single IEC covers all branches or factories of the same business across India. No separate IEC is needed for each location.

If not revalidated annually, DGFT may deactivate your IEC. Reactivation is simple: log in, verify your information, and confirm your business details online.

No, e-verification using Aadhaar is sufficient, making the application faster and easier, especially for small or home-based businesses.

Yes, IEC is needed even when goods are shipped via courier or post for business purposes, though personal packages are exempt.

Yes, for sole proprietors or individuals, PAN itself serves as the IEC number, eliminating the need for a separate identification number.

Typically, the IEC is issued within 1-3 business days after successful application and fee payment, making it quick for small businesses and online sellers.

Can i import anywhere in India if i have a valid IEC?