Payment Receipts: Best Practices, Benefits & Significance

- Payment Receipt: Know What it is

- Contents of a Payment Receipt

- Receipt of Payment: Significance for Businesses and Customers

- Is Providing a Payment Receipt a Must?

- Differentiating the Terms: Payment Receipt, Sales Receipt, and Invoice

- Creating Your Receipt of Payment: Different Methods

- How to Send Payment Receipts to Customers?

- Best Professional Practices for Designing and Dispatching Payment Receipts

- Invoicing Software: Generate Your Payment Receipts Seamlessly

- Conclusion

Have you ever wondered why you receive that little paper slip after making a purchase? It is simply a token of proof that shows you have made your payment. This piece of paper is termed a payment receipt.

Independent of the size of your business, you will need to provide your buyers with a receipt upon completing a transaction. It enables you to track your cash flow while also giving your buyers proof of payment.

This article details all you need to know about the payment receipt.

Payment Receipt: Know What it is

A document issued by a seller as proof of payment or completion of a specific transaction is known as a payment receipt. It ensures that the seller has received the amount for all the products or services sold. It is given once the complete transaction is finalised.

The payment receipt has been used as proof of payment for over 5000 years as per The American Numismatic Society. Right from the old Mesopotamian sellers to the 21st-century eCommerce vendors, proof of payment was made in many forms. Today, businesses issue these on sheets of paper or as digital copies.

Receipts are also given to the customer when deposits or partial payments are made in advance towards a bunch of goods or services.

The payment receipt is often confused with an invoice. Although these terms are used interchangeably, they are not the same. A payment receipt ensures that the seller has received the payment and an invoice is a document that informs the customer of the payment to be made. The most significant difference between the two is that an invoice requests a payment towards goods and services and the receipt is a document that confirms the payment made for the products or services purchased.

Contents of a Payment Receipt

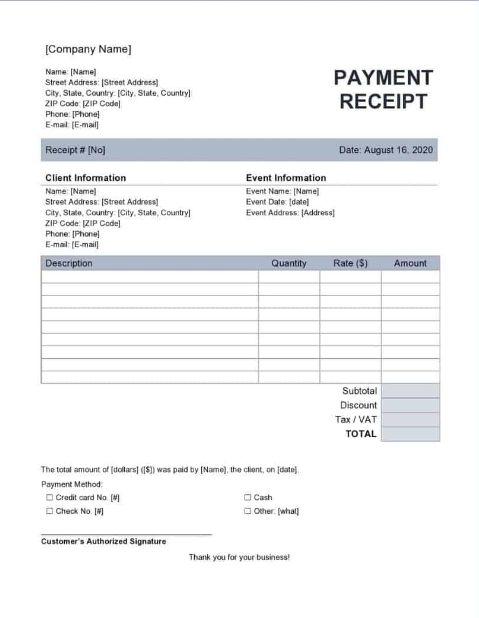

The format of a payment receipt does not matter. You must include certain details that are not to be forgotten. The essential components of the payment receipt are:

- The heading: The heading is a mandate that must always be mentioned on the payment document.

- Receipt number: This is a unique sequence of numbers, alphabets, or both to enable you to identify a certain transaction.

- Business particulars: The address, name, and contact details of the seller are to be indicated.

- Date of payment: The exact date of the payment made must be added to the receipt.

- Amount paid: You must also include a list of products bought by the consumer along with the price per product and the total amount paid.

- Particulars of the purchase made: The quality, small product description, etc., must be added to the payment receipt.

- Taxes, fees, and promotions: The taxes or VAT must be added to the payment receipt. Service charges and discounts must also be indicated on it.

When required, you must also add the following details:

- Customer information: The buyer’s name, address, and contact details can be added.

- Payment method: People can pay through different options and if you accept these different methods of payment, you can also include how you were paid.

- Invoice number: This is a unique number for a specific invoice and upon payment, you can add the invoice number on the receipt to enable easy cross-referencing.

- Verification of payment: You can use a signature to verify a payment. Signatures can be digital or handwritten.

Receipt of Payment: Significance for Businesses and Customers

Significance for Businesses

Having a record of all the receipts of payments is key for accounting purposes in any business. Payment receipts can be the record maintainer for all the purchases made through the year or a defined period.

When it is the appropriate time to give in your tax declaration and claim deductions, a record of these receipts makes it much simpler to complete the process. It also helps to segregate your expenses on business purchases.

These records also come in handy during audits and other such events. When a business issues a payment receipt, it shows that they are a transparent business. It in turn enhances customer trust and makes the business more consumer-centric.

Significance for Customers

A valid payment receipt is crucial for customers especially when they want to return their purchases, claim a warranty, request refunds, etc. These are generally subjected to the terms of a specific sale made and the payment receipt proves that you have purchased from that business.

Having a well-organized and consistent record of these invoices and receipts will allow the customer to maintain physical proof when issues arise. Payment receipts also help the customer budget and account better.

Receipts also allow the customer to maximize their tax deductions. In case they are also business owners, keeping track of all of their expenses is essential during filing taxes. Although card statements show the transaction, they are not sufficient to prove while filing taxes.

Is Providing a Payment Receipt a Must?

Every country has its own set of rules and regulations. However, providing proof of purchase after completion of a transaction is recommended in most countries. Australia is one country where this is not considered mandatory.

Payment receipts are to be provided even when a customer does not request one. In international trade, it is vital for the seller to pay attention to the laws relevant to the customer’s home country regarding the same. It is also important to know that regulations relevant to receipts are different amongst different industries.

Differentiating the Terms: Payment Receipt, Sales Receipt, and Invoice

The table below highlights the key differences between payment receipts, sales receipts, and invoices.

| Invoice | Sales receipt | Payment receipt | |

|---|---|---|---|

| What it is? | A document sent by a business owner to their customer to notify them regarding the payment owed for their goods and services is known as an invoice | A sales receipt is a formal document that a customer receives from a seller which has the amount they owe for a set of goods purchased | It is a proof of payment issued by the seller to the buyer to acknowledge that the payment is received for the purchase made for goods and services |

| Purpose | Invoices are documents that can be personalised and they can be used by all businesses for their products on credit | These have a generic structure and they are given to get paid instantly and they do not give any extension on the limit of credit | Payment receipts are issued as proof of payment for the purchase made |

| Use | These can be issued for recurring or single-sales | Seller receipts are issued once for instant payment for retail services | These can be used to claim refunds and replacements based on the terms of the sale |

| When is it issued? | Invoices are given upon product delivery with the payments due, date of payment, total amount owed, and period within which payment must be made | Sales receipts are also issued right after the purchase has been finalised. | Given post payment made |

| Benefit | They help with counting purposes and they help you keep track of all the sales and inventory | Acts as a purchase proof document between the seller and the buyer | Helps in claiming taxes and deductions on expenses due to businesses |

Creating Your Receipt of Payment: Different Methods

A payment receipt template can easily be made. There are different methods for generating a payment receipt. These can easily help you issue receipts to your customers and they also enable you to optimise and organise your financial and accounting processes. Here are three different methods for creating a payment receipt:

- Templates online: Today, the internet provides you with several premade or pre-designed online templates to generate payment receipts. This is the simplest method that you can use to make a receipt. It will help you save a lot of time in designing a template. Microsoft Word, PandaDoc, etc., help you generate receipts using online templates very easily.

- Receipt book: These are pre-printed books that help you make receipts of payment through handwritten methods. They allow you to create payment proofs easily and they have blank pages with sheets of carbon copy paper so that you can make two copies at once.

- Make your own: You can simply design your template. There are many software available online that allow you to create custom templates for generating online receipts.

How to Send Payment Receipts to Customers?

Once you have issued the payment receipt, you must send it to your customer. Here are two ways in which you can deliver your payment receipt to the customer:

- Offline receipt: Paper receipts are the most commonly used and issued receipts to the customer. It dates back to the 20th century. These receipts can be handed directly to the customer or later sent to their address via mail service. Here are some instances:

- Written receipts: These are physical handwritten sheets that entail details like the date of the transaction, business name, description of goods, etc.

- Printed receipts: These are generated by point-of-sale systems. They can have barcodes, QR codes, and other such details.

- Online receipts or e-receipts: In today’s world that live, breathe, and shop online, e-receipts are extremely popular. They are receipts issued for online transactions and these are more efficient and easy to maintain than handwritten ones. Some instances include:

- Email receipts: They are sent through electronic mail and they have the same data that a handwritten one would contain.

- Mobile receipts: You can scan, share, and store receipts on your mobile phone with features like purchase tracking, transaction history, etc for future reference.

- Digital payment confirmations: These are issued when you use electronic payment or net banking applications. They also contain similar information with the transaction ID and time of transaction.

Best Professional Practices for Designing and Dispatching Payment Receipts

Designing and dispatching payment receipts must be managed well to avoid chaos and disorganisation. Here are some professional practices:

- Efficient creation of payment receipts: Your invoice must not be too complicated. They must have the necessary details and nothing more. It must contain an itemised list of the purchases made along with the price per item, quantity, and total. This will allow you to avoid confusion and it also promotes organisation and efficient management.

- Effective record-keeping: Record-keeping, record handling, and record organisation are mandatory for the effective running of small businesses. They must be accessible and arranged such that you can take them whenever you need them without any hassle.

- Periodic review and adaptation: It is necessary for you to periodically go through your old records and make the necessary changes and adaptations to improve both your organisation methods and delivery methods of the receipt to your consumers. When you periodically review, you can optimise your processes to improve your efficiency.

- Sustainable alternatives: You might consider providing electronic receipts to achieve your sustainability goals. Moreover, these are more easy to handle, access, and maintain.

Invoicing Software: Generate Your Payment Receipts Seamlessly

Invoicing can be hard to keep up with. They require a lot of energy when done manually. Automating the process via invoicing tool can help you avoid all the burdens that come with the manual process. Here are some advantages of using invoicing software:

- Enhanced precision in data

- Simplification of invoice tracking methods

- Minimises duplication and other such errors

- Streamlines resources

- Easy accessibility and enhanced organisation

Conclusion

A payment receipt is proof of payment given by a seller to a customer. It is issued as soon as the payment is made by the customer for the purchase of goods and services. The receipt always details all the items purchased with the quantity and individual price along with the tidal. The additional taxes and the date of purchase are also indicated. This document is extremely valuable to both the customer and the seller. They both need to maintain records to track their sales, purchases, expenses, and cash flow. It also comes in handy when you need to apply for taxes, rebates, refunds, and so on. Today, receipts no longer have to be handwritten, you can easily generate them online via software thereby enabling you to always have a digital record.

No, these are not the same. An invoice is a document sent to customers requesting payment, whereas a payment receipt is a confirmation or proof that the payment has been made. These are issued at different stages of the sales process.

The GST law mandates that any registered person buying goods or services from an unregistered person needs to issue a payment receipt, in addition to a tax invoice. The type of invoice issued will depend on the category of the registered person that makes the supply.

The four most important reasons for issuing payment receipts include :

1. They act as absolute proof of purchase

2. Help in record keeping and accounting

3. Prove useful during the tax season

4. Serve as a form of legal protection