How to Conduct Break-Even Analysis to Manage Your Spends

The products you sell and the services you provide are important, but pricing management is what makes your business profitable. It’s crucial to conduct a break-even analysis to keep your business going and start making profits.

Break-even analysis is one of the critical functions for any eCommerce business. The break-even point in your business is the place where you’re not making any profit and incurring losses.

Break-Even Analysis

A break-even analysis shows the expenses and revenue of a company. Expenses are your operations costs. And revenue is the amount that you earn for selling your product or services. Expenses are your operating and production costs.

Why Should You Perform a Breakeven Analysis?

The break-even analysis allows you to determine expenditures when you move your business forward. This process can be helpful at the time of business launch. By assessing your business’ cost structures, you can predict several outcomes of your efforts. Benefits of conducting break-even analysis include:

- To get correct pricing of product or service.

- View of profitability.

- To adjust strategies for business progression.

How to Run a Breakeven Analysis?

Hopefully, we’ve conveyed the definition of this type of analysis, regardless of where you are in your campaign or business journey. Below, we break down the steps to run an analysis.

Data Aggregation

To run a break-even analysis you should identify all your expenditures for your business and divide those into two categories: fixed and variable.

Fixed Costs are expenditures that refer to expenses that remain the same, regardless of the success or failure of your business. Costs involved in this category include labor costs, rent, and software subscriptions, etc.

Variable costs are expenditures that depend upon how much you sell. For this type of expenditure, you can consider manufacturing materials, payment for business processing, operation costs, etc.

After verifying all of these costs, decide on an aggregate amount for each expenditure for each commodity.

Computation of Costs

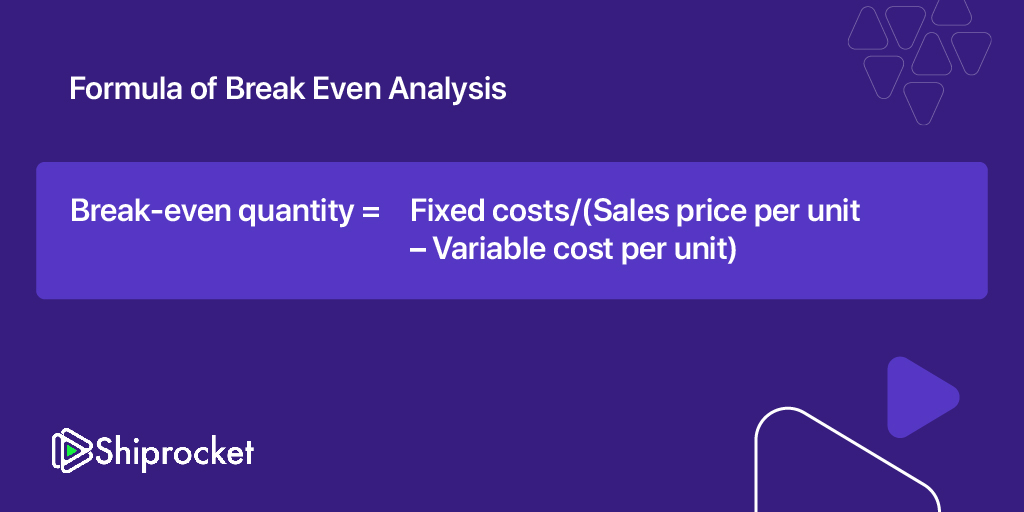

To run a breakeven analysis you need to calculate how many breakeven units are necessary for fixed costs divided by revenue per unit minus variable costs per unit. Once you determine your final break-even sales volume for your business. You can know how sustainable your goals are, and how to adjust your pricing and spend accordingly.

What Impacts Break-Even Analysis?

A breakeven analysis can be highly beneficial for assessing the profits and sustainability of your campaign. But there are unanticipated external factors that can result in incorrect projections and forecasting.

These factors can include:

- Incorrect data

- Lack of Understanding of Formula

- Time Management

- Market Competition

- Less Demand

In addition to these factors, what if the result of the break-even analysis does not match your budget? What should you do then? Below are strategies to follow if your break-even analysis shows unsustainability for your business.

Lower Your Fixed Costs

If you can reduce your fixed costs, just make it. The lower your fixed costs will be, the fewer units you need to sell to reach your breakeven point.

Increase Your Product Pricing

Increase your prices to reduce the number of units you need to sell to reach your break-even point. The more you charge for your products, the better product or service your consumers expect.

Minimize Variable Costs

By reducing variable costs you can scale your business regardless of what industry you’re in. Consider negotiating with your suppliers, changing your business processes, or even changing materials.

Conclusion

Regardless of whether you’ve decided to start your online store for the first time, the accuracy of break-even analysis is needed.

To ensure you get the best possible outcome, be sure to conduct a break-even analysis using granular detail on the costs and prices for your business. Plus, consider adding up miscellaneous expenses and all possible variable costs. Once you get the break-even point, be sure to monitor your performance through other metrics that can help your business succeed.

Short n crisp understating. Good guide before step in.Regards