Why Is Break-Even Analysis Important for Your eCommerce Business

Break-even analysis is a critical part of a business plan. It is the point where the sales revenue covers the cost of running the business. It is a financial analysis that you can run anytime. But, generally, it is done before introducing a new product or service. It helps in predicting whether your business or product will stay put in the long-run or not.

If you are running a business or planning to start one, you must know how to do a break-even analysis. It is a crucial aspect that will help you make well-informed decisions.

What Is a Break-Even Analysis?

Break-even analysis is a beneficial tool for determining the profitability of a business, product, or service. Financial calculation helps determine the number of products or services you need to sell to cover the cost of running the business. When a business reaches a break-even, it is neither making profit nor loss but only covering the costs.

For example, the break-even analysis can tell you how many laptops you need to sell to cover the cost of running a business or warehouse. Or how many customers you need to serve to cover your office rent. Anything you sell beyond the break-even point will add to profit.

To know your break-even analysis, you need to know the difference between fixed and variable costs.

- Fixed Cost: expenses that occur irrespective of how much you sell

- Variable Cost: expenses that fluctuate as per sales

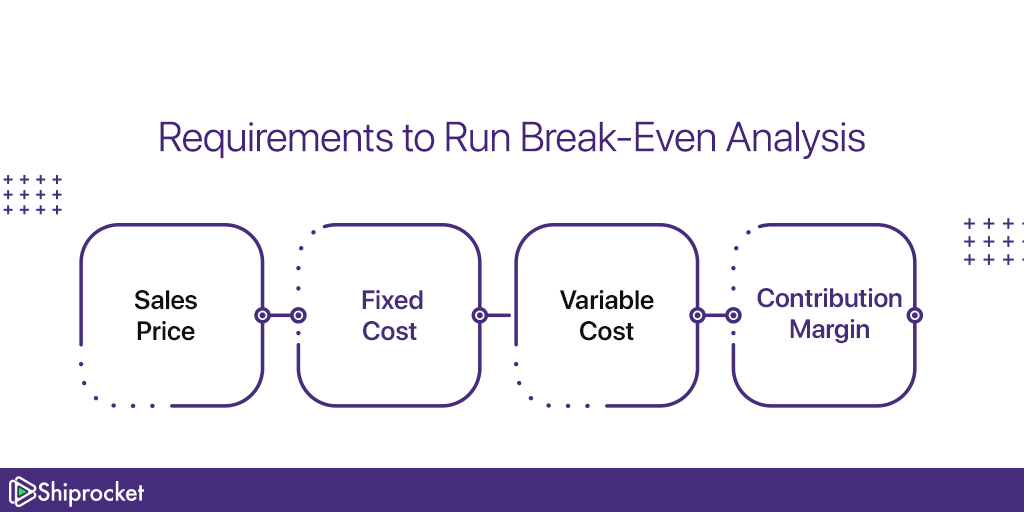

Requirements to Run Break-Even Analysis

Break-even analysis is built on market research, competitor analysis, and other such projections. To assess the break-even point, first, you need to evaluate four vital metrics:

Sales Price

Sales price per unit is the price that the business charges for its products. If you are at the product screening stage, the sales price per unit is the price at which you sell the item. However, if you are already running the business, you know the selling price.

One of the main reasons for doing break-even analysis is to ensure whether the unit price you have set would be profitable.

Fixed Cost

Also known as an overhead cost, fixed cost is an expense that a business incurs every month. It is considered a fixed cost as you must pay it irrespective you manufacture or sell any product or service. This cost is generally the same every month. The common examples of overhead costs are:

- Office rent or mortgage

- Office supplies

- Payroll

- Marketing cost

- Employee salaries

- Insurance payments

- Business license fee

Add up the total fixed costs for the time you are analyzing. You can also take an extra percentage to account for unforeseen expenses that may change your break-even analysis.

Variable Cost

The variable cost is not the same every month. It is the cost that you pay to produce one item. It is the cost of goods sold. The more products you produce and sell, the higher the variable cost.

If you have not yet launched the products, you can use the quotes from potential suppliers and third-party logistics companies to calculate the variable cost.

The examples of variable costs are:

- Raw materials

- Shipping cost

- Taxes

- Utilities

- Vehicle expenses

- Factory overhead

- Processing fees

Contribution Margin

Contribution margin tells how much a single item contributes towards the business revenue. It is the difference between the product’s sales price and variable cost. If the contribution margin for a product is low, it does not impact your revenue much. But, later, this may also lead to your business losing money while producing products.

How to Calculate Break-Even Point?

Let’s suppose your company manufactures apparels and has the following production numbers:

Fixed Cost: Rs. 5,00,000

Variable Cost per Unit: Rs. 70

Sales Price per Unit: Rs. 100

As per these figures, the break-even units for your business are:

Break-Even Units: Fixed Cost / (Sales Price per Unit – Variable Cost per Unit) = Rs. 500000 / (Rs. 100 – Rs. 70) = 16,667 Units

And,

The break-even sales are:

Break-Even Sales = Unit Sale Price x Break Even Units = 100 x 16667 = Rs. 16,66,700

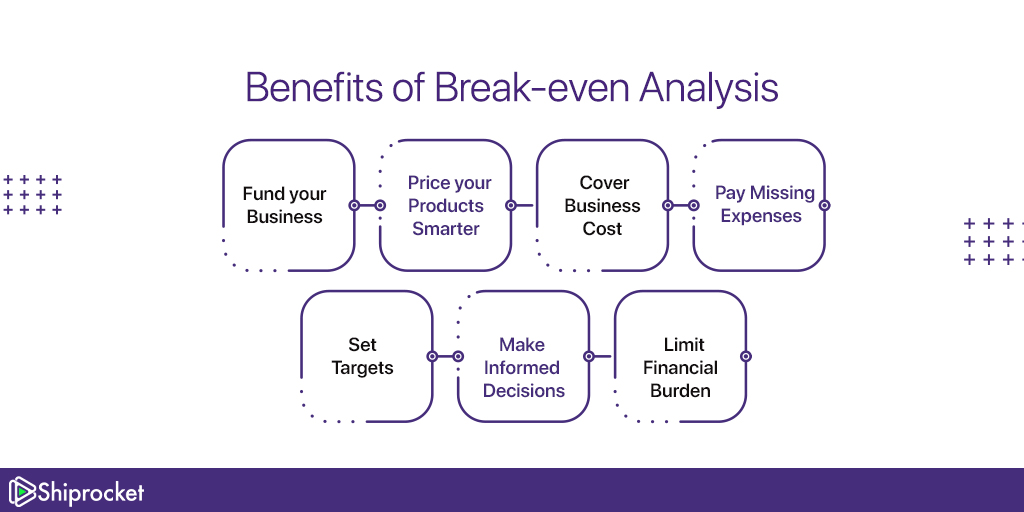

Benefits of Break-Even Analysis

The following are the benefits of break-even analysis for your business:

Funding Your Business

Break-even analysis is a crucial aspect of a business plan. A business plan is very important if you wish to apply for a business loan or want investors to invest in your business. You need to show them your plan and prove your business is viable. Moreover, if the analysis looks good to you, it will boost your confidence to proceed ahead.

Pricing Your Products Intelligently

Finding the break-even point for your business will help you price your products in a better manner. Effective product pricing is crucial as the entire future of the business (profit) depends on it. Product pricing can make or break your business. It ensures that you pay all your bills (fixed plus variable costs).

Cover Business Costs

When you think of an effective pricing strategy, you also think of the cost of producing the product. As discussed, this cost is variable. You also need to cover fixed costs like rent and insurance. Performing a break-even analysis will help you meet your expenses efficiently.

Cover Miscellaneous Expenses

A small business owner often forgets petty business expenses. But they can add up to become a significant cost. Doing a break-even analysis can help you meet all the financial commitments with ease.

Set Targets

By doing a break-even analysis, you will get an idea about how much you will need to sell to earn profits. This will help you set sales goals and revenue targets for your entire team. If you have a clear number in mind, it will be easier to follow the targets.

Make Informed Decisions

It is not viable for the business owner if he takes decisions based on emotions or assumptions. It is important to make decisions based on facts, reports, and calculations. It will be easier to decide whether to start with the idea or not if you have required data with you.

Limit Financial Burden

Doing a break-even analysis will limit the risk by avoiding the business idea that is not viable. It will help you avoid failures and limit the financial strain you may incur due to bad business decisions. You can be realistic with the outcomes of your decisions.

The Final Words

When you start a business or introduce a new product in the market, the risk is natural. You invest your time, energy, and money into the idea without knowing how your potential customers will respond to it. A break-even analysis will help you know about the idea in advance. You will have an idea about how much you need to work to ensure your idea works.

You can use the break-even formula to determine what price strategy you must adopt. Or how many product units/services you need to sell to reach the break-even point. You also get better control of your fixed cost and variable cost. Besides, the break-even analysis also helps you keep your business on track within the right time-frame.