Building Success Stories with 3 Lakh+ eCommerce Brands

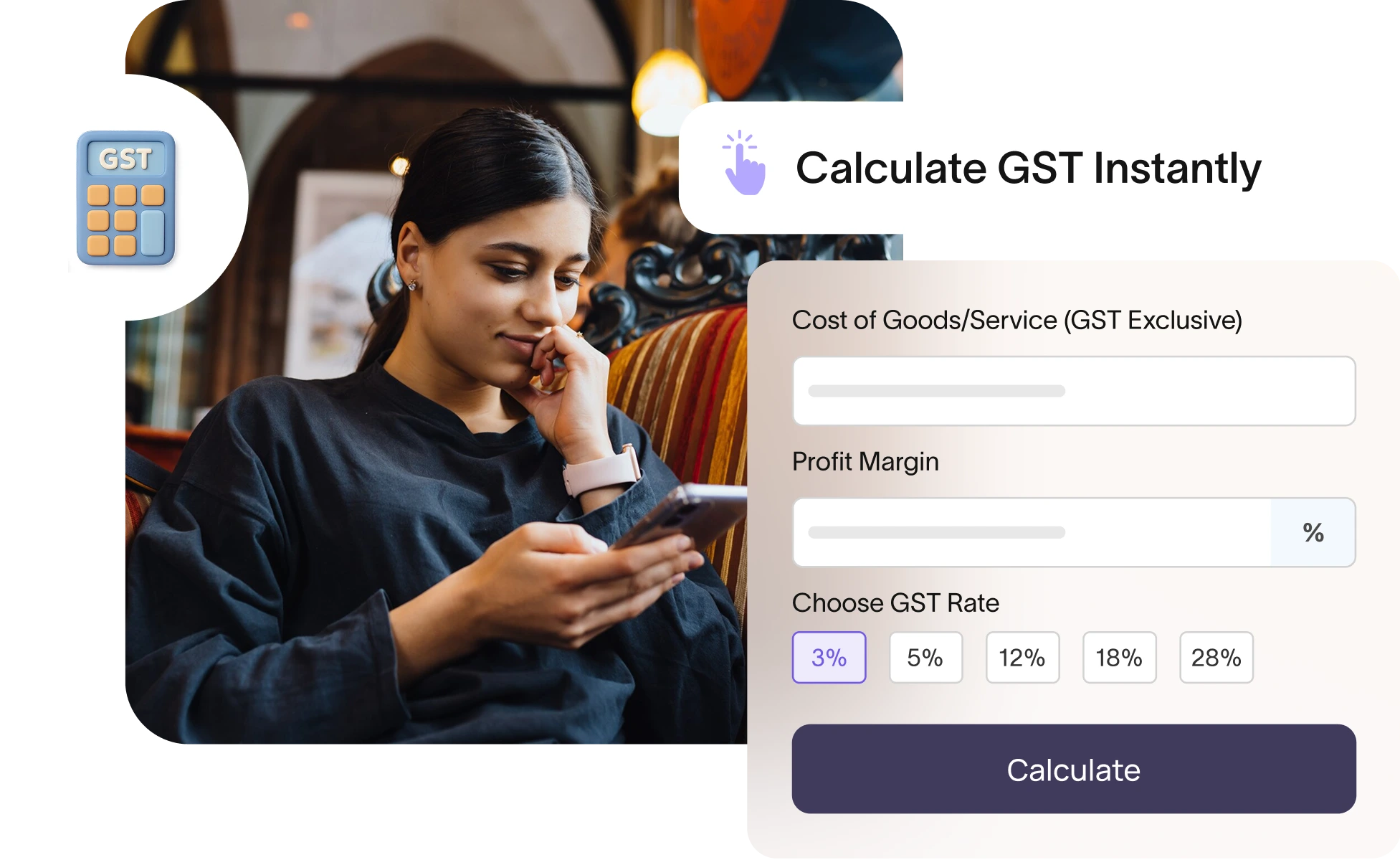

Calculate GST Instantly

Easily calculate GST on your goods and services in just a few clicks. Shiprocket’s free GST calculator helps you determine the GST amount, total selling price, and profit margin—all in seconds!

Total Selling Price